You may be ready to move home before your current mortgage comes to an end. This means we need o to have a conversation with you, your current lender and maybe a different lender to find out the best way to manage your mortgage when you move.

There are many different things to consider with your mortgage as you may currently be fixed into a long-term deal but don’t worry, the vast majority of lenders all want you to take your mortgage to the next property with you. This is called porting.

But what if you’re upsizing or moving to a more expensive area and need more money? Again most mortgage lenders offer you the option to borrow more on your current mortgage to help with the purchase. This is called additional borrowing.

So, let’s say you have a £100,000 mortgage fixed for a further 3 years. You now want to take this mortgage to a new property (port) but require an additional £50,000. As long as you meet the lenders affordability assessment, they will provide this money on top of the current £100,000.

The only issue can be that the mortgage lender may only be offering two-year and five-year fixed interest rates at the time so you will end up having two separate elements to your mortgage needing renewal at different times. This needn’t be a major hassle and is certainly something we help you manage, but something to bear in mind.

How about paying off the mortgage with funding from a new one?

In some cases we would look at redeeming the current mortgage, but this needs very careful management as it may mean you’re asked to pay Early Repayment Charges (ERC). We’d need to look at your current financial circumstances and figure out if this is a cost-effective method of managing your home movers mortgage.

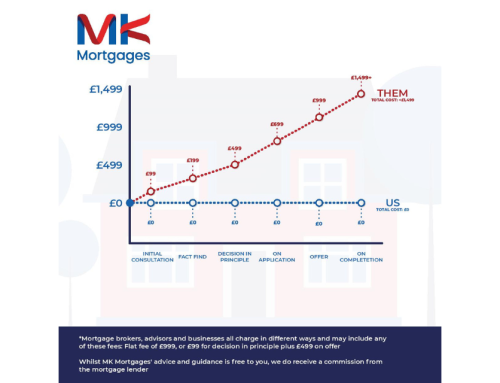

As with all of our mortgage advice processes, we don’t charge you any fees for working through the affordability question, submission of your application, or the general updates during your moving home journey.

For more information on mortgages when moving home please get in touch for fee free advice.

Call Marc on 07880 647535 or email the office on mk@mkmortgages.com.