Most people would see that something is free, and think to themselves, ‘what’s the catch?’. And to be fair, you’d be right to assume that it could mean hidden charges, or biased advice in order to secure a better lender commission, we wouldn’t blame you!

The fact of the matter is that we don’t charge any fee to you for the advice, or administration of your mortgage case because we don’t have to. Simple.

Yes, we do get a commission payment from the lender when your mortgage completes, but the payment doesn’t vary that much and has no influence on which mortgage product we help you choose. And the final decision is yours…

How much do other advisers charge for mortgage advice?

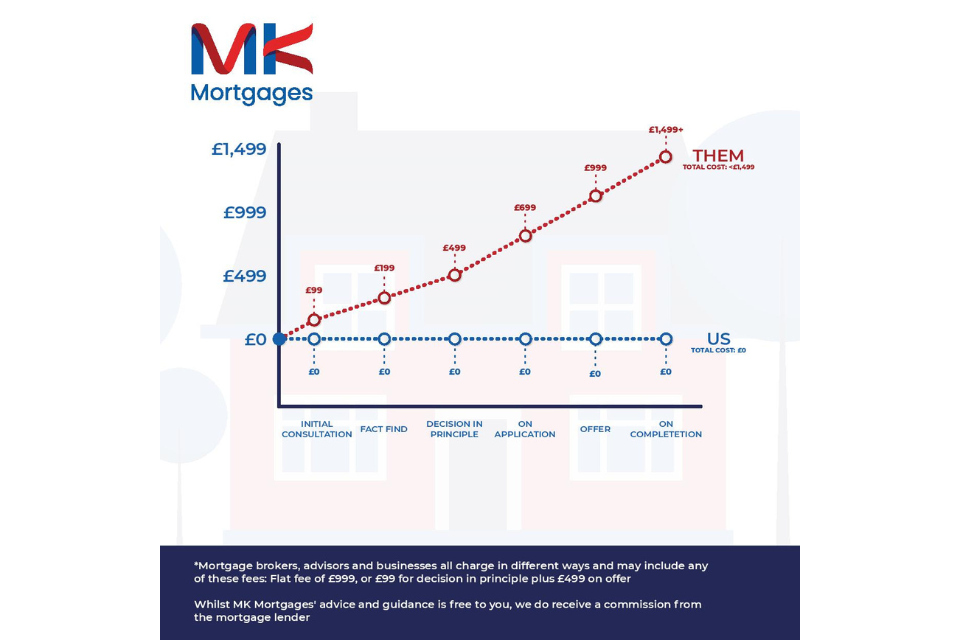

The cost of mortgage advice in the UK can vary depending on the level of service provided and the adviser’s discretion. Generally, mortgage advisers charge either a flat fee per case, or a percentage of the mortgage amount.

We’ve seen mortgage advice in Oxfordshire ranging from around £200 to £1,500 or more, depending on the complexity of the case and the experience of the adviser. Some advisers may also charge additional fees for ongoing advice or guidance.

Alternatively, some advisers may charge a percentage fee based on the size of the mortgage. This fee can vary but typically ranges from 0.25% to 1% of the mortgage amount. For example, on a £200,000 mortgage, the fee could range from £500 to £2,000.

What are the catches with free mortgage advice?

Some mortgage advisers offer a free initial consultation to discuss your needs and circumstances and take you through how they can help you.

It’s important to note that some advisers may also charge initially, and then waive their advice fees if you choose to take out a mortgage with a lender they recommend. However, it’s important to consider the overall cost and value of the advice before making a decision.

In the UK, the Financial Conduct Authority (FCA) requires all mortgage advisers to provide a suitability assessment, which involves gathering information about your circumstances and needs, recommending a mortgage product and explaining why it’s recommended for you. This is the service that the fee usually covers and is the standard all mortgage advisers must adhere to.

The commission that MK Mortgages receives from the lenders covers the cost of our time to go through this process, so we don’t feel we need to charge you as well.

What makes us truly different though, is the extra time we take to make sure all your questions are answered, and if we have to go back a few steps to make you feel comfortable with your decision, then that’s OK too.

So, when researching which mortgage adviser to use, make sure you get a clear explanation of fees, and ask them if they’re whole of market too.

If you’d like to talk to us, call Marc Kavanagh, the man with Mortgage Knowhow for mortgage advice without the fees…