The housing market might seem daunting, but remember, newspaper headlines are designed to scare you! Terms like ‘mortgage crisis’ really are inaccurate if you look at the facts…

Property prices

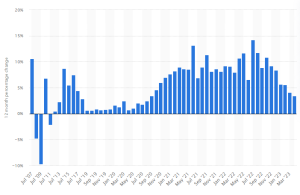

Whilst property prices do fluctuate year on year and even month on month, over the long-term, property prices tend to increase. Compare the price of the average house in the UK today, to that of the past however, and you will see there was a drastic rise in house prices following the pandemic, with a subsequent drop in recent months.

12-month percentage change in house prices in the UK from July 2007 to April 2023 Statista

We sadly cannot predict the future of house prices, but we can say that the sooner you seek whole of market advice from a professional mortgage adviser, the better.

Mortgage payments vs rent payments

When you take out a mortgage you will have a known monthly cost for a set period of time. When you rent, your landlord may considered be a variable factor, in that it is unknown how often or how much your rent might increase.

What I’m trying to get at is, you can predict your payments and be safe in the knowledge that they won’t change for a longer period with a mortgage. And every month you pay it off, the closer to home ownership you become.

We see a majority of clients take mortgages over a 25 to 40-year term depending on their age or budget. Most mortgage products we help our clients with range from 2 to 5 years before they will need renewing. As you approach the end of the product we are in touch to help arrange a new mortgage deal based upon your situation at that time.

If you’re making plans for your future, financial predictability is key.

Mortgage rates

While you might immediately notice the sharp increase in mortgage rates on the right of this graph, I would draw your attention to the remarkably low rates leading up to it, and in fact, compare the current rates to those on the left of the graph.

Average interest rates for mortgages in the United Kingdom (UK) from March 2000 to May 2023, by type of mortgage, Statista

The increase has been recorded at a record high in terms of how quickly they’ve increased, but not a record high in cost. It’s just that we had a record low during the pandemic.

Is now the right time to be a first-time buyer?

Realistically speaking, becoming a first-time buyer is going to be a big change for you and might be a tough change to make. You may need to reconsider phone upgrades, TV streaming bundles, gym membership and car leases among other things, but the sooner you seek advice, the better your decision making can be. And you’re not alone, people taking out a remortgage are getting the same advice.

I want to help you get on the property ladder, I don’t want you to delay your life’s plans because you can’t decide whether now is the right time to buy a house or not. So, I offer whole of market mortgage advice, and I don’t charge you because if you take a mortgage with me, the lender pays me commission.

You’ve got nothing to lose except a few hours, but stand to gain a lot of understanding…

(This blog, and stats updated June 2024)